Family Medical Insurance Plans and Also the Health Care Demands of Your Loved Ones

In spite of each of the innovations in modern day medicine, it can easily be a challenge on an common, working-class home when one member gets sick. The catch is not about the strength of the medicines or operations, but with access. Health Care can easily be extremely expensive to the normal person today unless you know about affordable major medical insurance and just what it can easily do in your case and your family.

All About The Insurance coverage

Family medical insurance plans focus on coverage. This is about the different varieties of health conditions and healthcare activities your plan will finance. Most major health plans cover basic principles like trips to the doctor, the expense of hospital stay, outpatient care, and trips into the emergency room. Other things your coverage might cover include at-home healthcare and preventive treatments.

It can easily also pay money for some of the medicines you are recommended by doctors. You can easily always ask your healthcare supplier when there is a gap within the coverage by the plan for any of one’s prescription medication. You may get the medication taken care of with special consideration, if you make a case because of it.

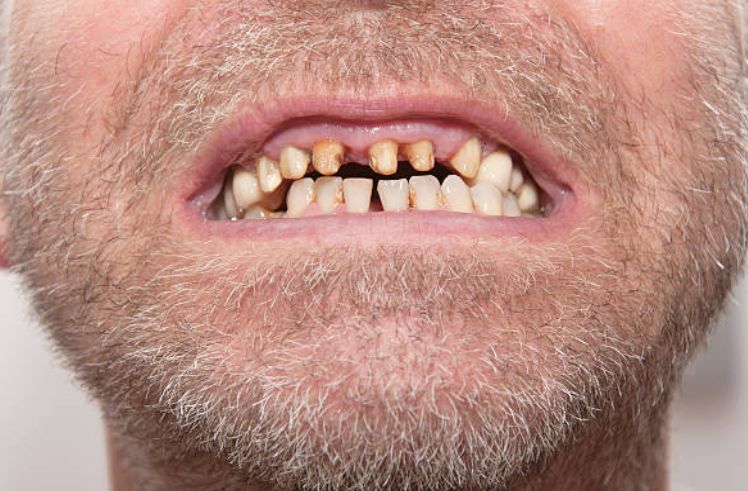

Extra coverage of what is major medical insurance might include dental, vision and specialist care, therapy of misuse of habit forming substances, and psychological healthcare. Some plans supply these as add-ons with a basic scheme.

The protection of medical expenses marked under “catastrophic” is normally by a separate policy or as the significant add-on to your existing plan. This deals with big expense medical care like major medical problems, personal nurses, leasing of medical tools, laboratory work, and major surgical procedures. At times, they also have something called “coinsurance” where both you and your supplier share the protected costs that go beyond the deductible sum.

Take into account that most family medical insurance plans do not cover maternal care. The ones that do offer maternal care usually require a year following your policy’s effective date for coverage. In addition, lots of plans do not cover some types of dental operations and aesthetic surgery.

Picking Your Plan

The prices for plans are in the regulations of each particular state, so the rules can easily vary depending on your home and/or work. This would mean premiums are usually similar for any given coverage. The difference is normally in the type and level of coverage you chose.

The key part when choosing family medical insurance plans is in being aware of what you’ll need. A thorough plan can easily cost a lot with the add-ons to the fundamental package. Simply acquire coverage for what your household need, for now at least. This can easily also protect your financial situation from a wipe out in case of a catastrophic sickness.

Lastly, do business with medical providers that have a great standing. Other than dealing fairly and professionally, these offer the best family medical insurance plans around you can easily afford. In this manner, your folks are protected and so are your finances.

Comments are closed.