How Canadians Can Benefit From Having Health and Dental Insurance Coverage

Canadians benefit from a publicly funded national health insurance program which provides for the basic coverage in hospital care. While as Canadians we receive coverage to some extent, each province and territory may offer additional benefits according to their own respective plans.

If you’re a Canadian, and you have lived in a few of the provinces over time you would best understand how coverage varies considerably from province to province.

Health & Dental Insurance

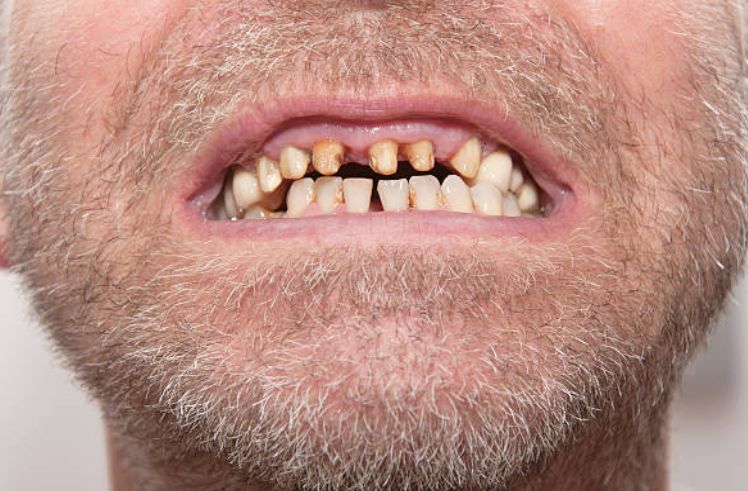

The average costs for a dental cleaning varies, but generally on average you’re looking to pay between $150 to $200. Besides cleanings; Fillings, extractions, and root canals can set you back hundreds of dollars.

Prescription medications

Provincial governments offer partial or complete coverage for seniors and those receiving social assistance. What about the rest of the Canadian working class, how can they fill in the gaps where coverage is not an option?

This is where supplemental insurance becomes necessary for many. Some insurance companies offer discounts for couples and families with 3 children or more worth looking into.

Supplemental health insurance plans can include the following types of therapies;

• Psychiatry

• Physiotherapy

• Osteopathy

• Naturopathy

• Chiropractor

• Podiatry

You may want to ask yourself the following question when deciding whether or not you need a health insurance plan;

Do I need prescription, vision, or dental coverage?

Supplemental insurance plans usually cover about 40% to 80% of healthcare needs such as: dental, vision, psychologists, podiatrists, chiropractors, hearing aids, and various medical devices.

There are many factors that are weighed into what your monthly plan will cost. Here are a few of the questions you would have to answer to get your rate.

• The number of individuals included in the plan

• The type of coverage you need

• Whether or not you want prescription drug coverage included in your plan

• Your current health, family medical history

• Whether you are a smoker or non-smoker

• Gender influences your rate

• Your profession

• Where in Canada you reside

Whether or not you choose to invest in a supplemental health insurance plan is up to you. The idea is not to wait until you have a health condition or you need a medical service not covered under the Government Heath Plan to inquire about a plan. You want it accessible at the time that you need it. When it comes down to it; health insurance plans are customizable to fit your needs and the needs of those who will have coverage with you.

Comments are closed.